-

Every business in the cannabis industry needs a dependable General Liability Insurance policy. Find out exactly how and why we go the extra mile to provide you with the Gold Standard in basic General Liability coverage. Read more!

-

Whether or not your business manufactures or sells cannabis products, Cover Cannabis is ready to provide you with access to some of the best insurance options in the industry to protect you against crippling law suits in case you are found liable for manufacturing or selling defective products.

-

You do not want the unpleasant experience of discovering the vehicles involved in your cannabis operation have not been as thoroughly covered as you expected. Cover Cannabis will explain to your satisfaction, not only why you a need business auto insurance policy, but how and why Cover Cannabis offers some of the best coverage to protect you in case the vehicles in your operation incur an accident while on the job.

-

New cannabis businesses often find themselves in the dark when deciding whether or not their employees require workers compensation insurance. Cover Cannabis will enlighten you to the cold hard facts of affordable workers compensation insurance and why it is essential to the success of your business.

-

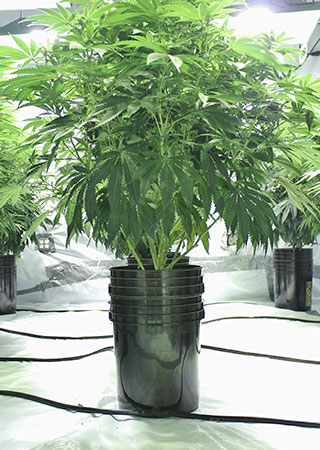

Properties from indoor growing facilities, greenhouses, extraction production plants and laboratories all need to insure their premises. Find out how Cover Cannabis is ready to protect your business property to your confident satisfaction so you can sleep easy at night knowing your business can continue to prosper even if disaster strikes.

-

Cover Cannabis can help cover your licensed indoor or approved licensed greenhouse facility crops. Come harvest time, there’s even more protection we can offer you as well! From seed to harvest licensed indoor and greenhouse growers can be rest assured that their crops are protected! And for outdoor licensed growers, once you’ve brought your harvest indoors for processing, storage, and delivery, check out the full range of protection plans we have to offer your business as well.

-

Items transported for your business or by your business may be your responsibility should they become damaged or lost. Without solid cargo insurance to protect cannabis companies, they can suffer serious business set backs or even the complete loss of their businesses from unexpected disasters. Discover why Cover Cannabis can provide access to some of the most comprehensive cargo insurance policies in the industry and how your cargo can be protected from dangers.

-

Did you know that equipment coverage, and equipment breakdown coverage are two separate insurance policies you need to keep your cannabis business running efficiently? Let Cover Cannabis define the unique differences between the two and how we can provide you with access to some of the most cost-effective protection for your equipment coverage.

-

The dream of any business owner is to find a insurance coverage that only protects equipment from loss or damage, but covers the cost to repair or even fully replace equipment due to mechanical breakdowns that are beyond repair. Find out how Cover Cannabis can help make your insurance dream an affordable reality with equipment breakdown coverage.

-

Business income insurance refers to coverage that pays for the loss of business income while your business is being repaired or rebuilt after being damaged by a covered cause, like fire or vandalism for example. Extra expense insurance refers to coverage for the additional expenses incurred while your business is being repaired or rebuilt. Both coverage options now available for cannabis businesses.