The Farm Bill is a comprehensive piece of legislation that governs various agricultural and food programs in the United States. It includes provisions for commodity programs, conservation, nutrition assistance, and crop insurance. The 2024 reauthorization of the Farm Bill is crucial as it sets the framework for these programs over the next decade.

The current Farm Bill is set to expire in 2024. Congress faces a tight legislative calendar to reauthorize the new Farm Bill before this deadline. Despite efforts, substantive progress has been slow, and the chances of reauthorization in 2024 are diminishing.

As of midsummer 2024, Congress has made minimal progress on the Farm Bill. The House Agriculture Committee reported its bill just before Memorial Day. In June, Senator John Boozman released a series of summaries outlining the Senate Republicans’ framework for the Farm Bill. However, significant legislative movement has stalled.

The reauthorization faces several challenges:

The Farm Bill impacts a wide range of stakeholders:

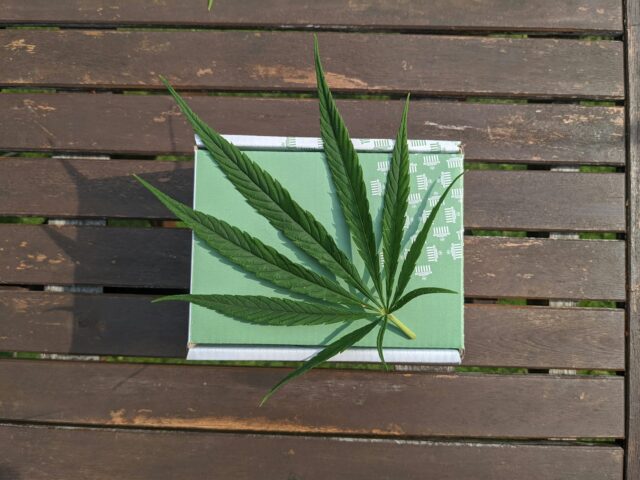

The Farm Bill also intersects with issues facing cannabis businesses, particularly through tax regulations like Section 280E of the Internal Revenue Code. This section prohibits cannabis businesses from deducting ordinary business expenses, impacting their profitability. However, changes in federal laws or future Farm Bill provisions could potentially address these challenges for cannabis companies.

The Farm Bill 2023 has seen a number of developments:

In terms of specific proposals, the bill concentrates on funding to combat the citrus disease Huanglongbing, and may expand climate-saving ‘agroforestry’5. However, it has been criticized by some for lacking details on spending6.

The 2023 Farm Bill has several key provisions that address the diverse needs of farmers and the agricultural industry:

In addition, the NRDC has outlined some priorities for the 2023 Farm Bill2:

Former Sen. Saxby Chambliss, who worked on the last farm bill, mentioned that these bills affect food prices, availability, global trade, and renewable fuels. The current farm bill WILL expire in September 2024, so lawmakers and advocacy groups are already preparing for the new bill. We sincerely hope the extra time will allow for them to include hot topics from coast to coast.

The Updated 2024 Farm Bill has several policy priorities. Some of these priorities include increasing baseline for farm bill program spending, maintaining a unified farm bill which keeps nutrition programs and farm programs together, prioritizing risk management tools and funding for both federal crop insurance and commodity programs, and ensuring adequate USDA staffing capacity and technical assistance.

From healing ointments to calming supplements. The cannabis industry is flourishing.

The 2018 Farm Bill significantly changed the legal landscape for hemp in the United States. It removed it from the list of controlled substances and categorized it as an agricultural commodity. This allowed for the cultivation, production, and sale of hemp and hemp-derived products, including CBD, under specific regulations. Since then, the hemp industry has flourished all over the country. The production of hemp-derived CBD became legal at the federal level, as long as it contains no more than 0.3% THC. However, individual states have the authority to regulate or ban CBD within their borders. It is safe for us to presume that the 2024 Farm Bill may include legislation about hemp as there are issues that need to be resolved in order to improve the sector. One of these issues is the FDA’s position on CBD. Lawmakers, stakeholders, and witnesses have highlighted reforms they aim to include in the 2024 Farm Bill in order to reshape and improve the hemp industry.

The spark our industry needs.

The 2024 Farm Bill is very likely to include several provisions that relate to hemp and cannabinoids. The current dividing line between hemp and marijuana is 0.3% THC. The 2024 Farm Bill may increase the allowable THC amount to 1%1. Lawmakers, stakeholders, and witnesses have highlighted reforms they aim to include in the 2023 Farm Bill in order to reshape and improve the hemp industry2. The bill could change the game for THC products3.

As the legal landscape surrounding hemp and marijuana continues to evolve, businesses operating in these sectors need comprehensive insurance coverage that accounts for the unique risks and challenges they face. Here at Cover Cannabis, we offer tailored insurance solutions for hemp and marijuana-related businesses, including cultivators, processors, manufacturers, dispensaries, and ancillary service providers. Our services are designed to protect businesses from financial losses that may result from property damage, liability claims, product recalls, and other unforeseen events. With our expertise and understanding of the cannabis industry, Cover Cannabis can help businesses navigate the ever-changing regulatory landscape and ensure they are adequately protected. Contact Us for a Free Quote or Give us a Call.

Hemp and marijuana both come from the Cannabis sativa plant, but they have distinct differences. Hemp contains less than 0.3% THC, the psychoactive compound responsible for the “high” associated with marijuana. Because of its low THC content, hemp is considered non-intoxicating and has been legalized for agricultural and industrial purposes.

Hemp farms cultivate Cannabis sativa plants containing less than 0.3% THC for industrial and agricultural purposes, such as producing fiber, oil, and CBD. Marijuana farms grow Cannabis sativa plants with higher THC content for recreational or medicinal use.

The USDA’s final rule for hemp production, published on January 19, 2021, establishes a regulatory framework for hemp cultivation, including licensing, testing, disposal of non-compliant plants, and recordkeeping requirements.

Cover Cannabis is a company specializing in reliable, discreet, and professional cannabis insurance services for cannabis-related enterprises. Our team comprises seasoned insurance professionals with experience in underwriting and claims management. As the legal landscape surrounding hemp and marijuana continues to evolve, businesses operating in these sectors need comprehensive insurance coverage that accounts for the unique risks and challenges they face.

Marijuana Cafes and Bars might just be around the corner.